form 1098 t 1040

Form 1098-T, Tuition Statement - Internal.

Attention: This form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form. Do . not. file copy A downloaded from this

Income from 1098-t where do i report it.

2013 Form 1098-T - Internal Revenue Service

How to report Tuition Statement Form 1098.

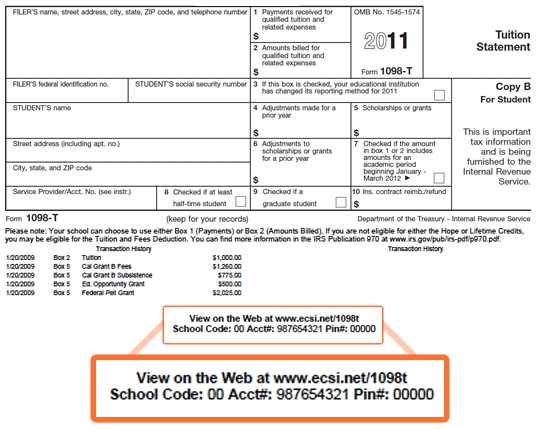

Kaplan Higher Education is required by IRS Section 1.65050S-1 to send Form 1098-T to students who had payments made to their account for qualified tuition and related

2013 Form 1098-T - Internal Revenue Service Form 8917 FAQS about Form 1098-T - Student Service Center

17.04.2011 · Best Answer: The educational institution makes the choice of whether to report (1) amounts billed for tuition, or (2) amounts actually paid to them. One or

FAQS about Form 1098-T Q: What is a Form 1098-T? A: Colleges and universities are required under Internal Revenue Code Section 6050S to issue the Form 1098-T for the

REV: 1/13/12 Student Accounting IRS Form 1098-T Frequently Asked Questions University Hall 365 Phone: (818) 677-8000, Option 2 Fax: (818) 677-7878

14.02.2009 · A 1098-T just shows tuition paid to a qualified higher-education institution. Depending on your age, how long you've been in school, how much was paid via 1098-T Form Download

FAQS about Form 1098-T - Student Service Center

Form 1098-T, Tuition Statement. Eligible educational institutions file this form for each student they enroll and for whom a reportable transaction is made.

form 1098 t 1040

form 1098 t 1040

.